Let’s End World Hunger with Food for All

Recent Blogs

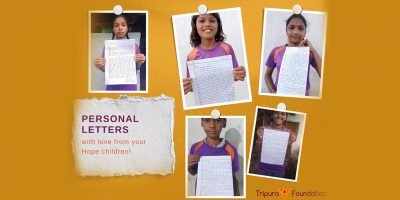

An Exchange of Letters | An Example of HoPE between Kavipriya and David!

Hope children eagerly pen heartfelt letters of gratitude to their cherished sponsors. By...

Hope Superstar Saisha | I Have Learned Many Things That Have Changed My Life

Saisha Maulingkar is studying in standard 3rd at Government Primary School Bottor, Goa. She lives...

Mini Meals for Hope Children | Help Children Stay Focused, Have More Energy & Give Back!

Parents who send their children to Hope Learning Stations know they will receive learning and...

What We Do

Feed

We feed at least 4,500 hungry children and elderly each month. Nearly 15 million meals fed to date.

Educate

We have educated over 150,000 underprivileged children in over 1,125 schools in 4 countries with revolutionary Phonemic Intelligence technology.

Shelter

We improve living conditions for hundreds of abandoned elders with nowhere to go and have built more than 30 homes.

Support

We provide basic necessities for over 4,000 impoverished children and their families to live with dignity each year.

Empower

We inculcate compassionate life-skills into our children as the future leaders of tomorrow.

Hope

We give the hope of a new destiny to those who were previously forgotten,

Our Students Practice Phonemic Intelligence

Where We Operate

India

United States

United States

Tripura Foundation in the United States.

India

Tripura Foundation in India.

A Word of Hope from India

“I sincerely want to thank our sponsors and Tripura Foundation for giving children like us a hopeful childhood so that we can have a brighter future with all of your support. I would also like to thank them for providing us with the evening snacks as they are a major source of healthy food for us.”

Bhavani –Hope Learning Center beneficiary.

With your help, we can help more children like Bhavani. Click the button below to make a donation now.

Sponsor a Hope Learning Center

Want to transform communities and the lives of 40 children?

For $350 p/mo or $4,200 a year, you can sponsor your own Hope Learning Center.